The difference between the two is that the EAPR accounts for fees and compounding, while the nominal APR does not. The annual percentage rate (APR) may refer either to a nominal APR or an effective APR (EAPR). The amount of interest payment depends on the interest rate and the amount of capital they deposited.īase rate usually refers to the annualized effective interest rate offered on overnight deposits by the central bank or other monetary authority. In return, the bank should pay interest to individuals who have deposited their capital. (The lender might also require rights over the new assets as collateral.)Ī bank will use the capital deposited by individuals to make loans to their clients. In return, the bank charges the company interest.

The interest rate has been characterized as "an index of the preference.

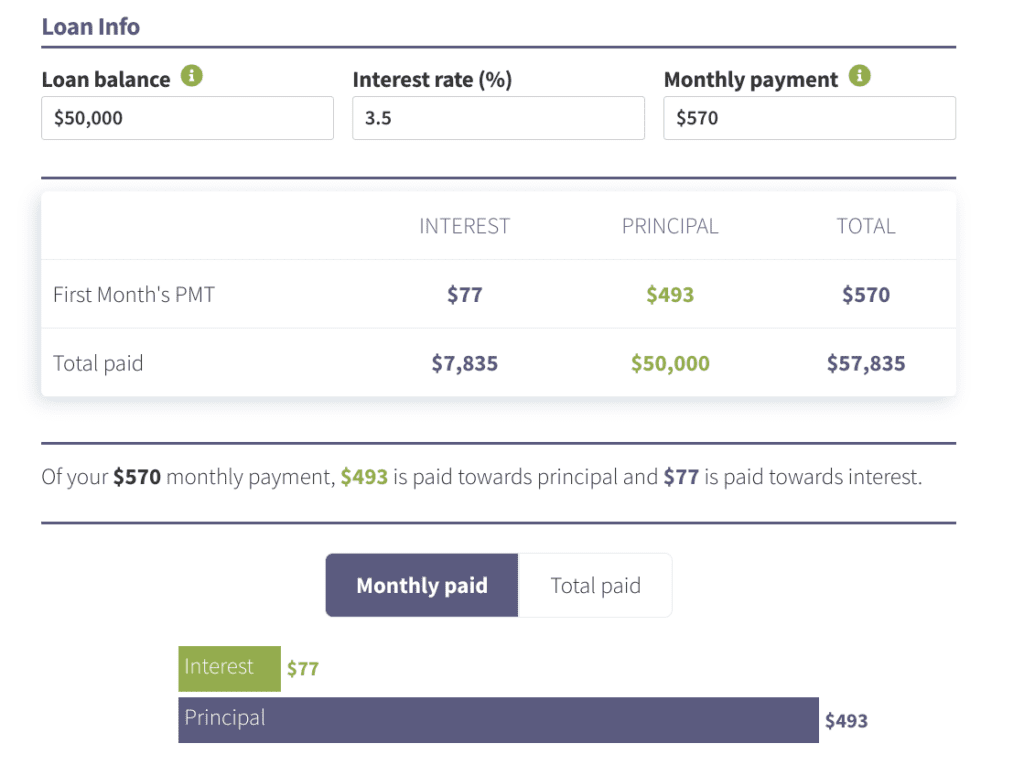

Other interest rates apply over different periods, such as a month or a day, but they are usually annualized. The annual interest rate is the rate over a period of one year. The total interest on an amount lent or borrowed depends on the principal sum, the interest rate, the compounding frequency, and the length of time over which it is lent, deposited, or borrowed. An interest rate is the amount of interest due per period, as a proportion of the amount lent, deposited, or borrowed (called the principal sum).

0 kommentar(er)

0 kommentar(er)